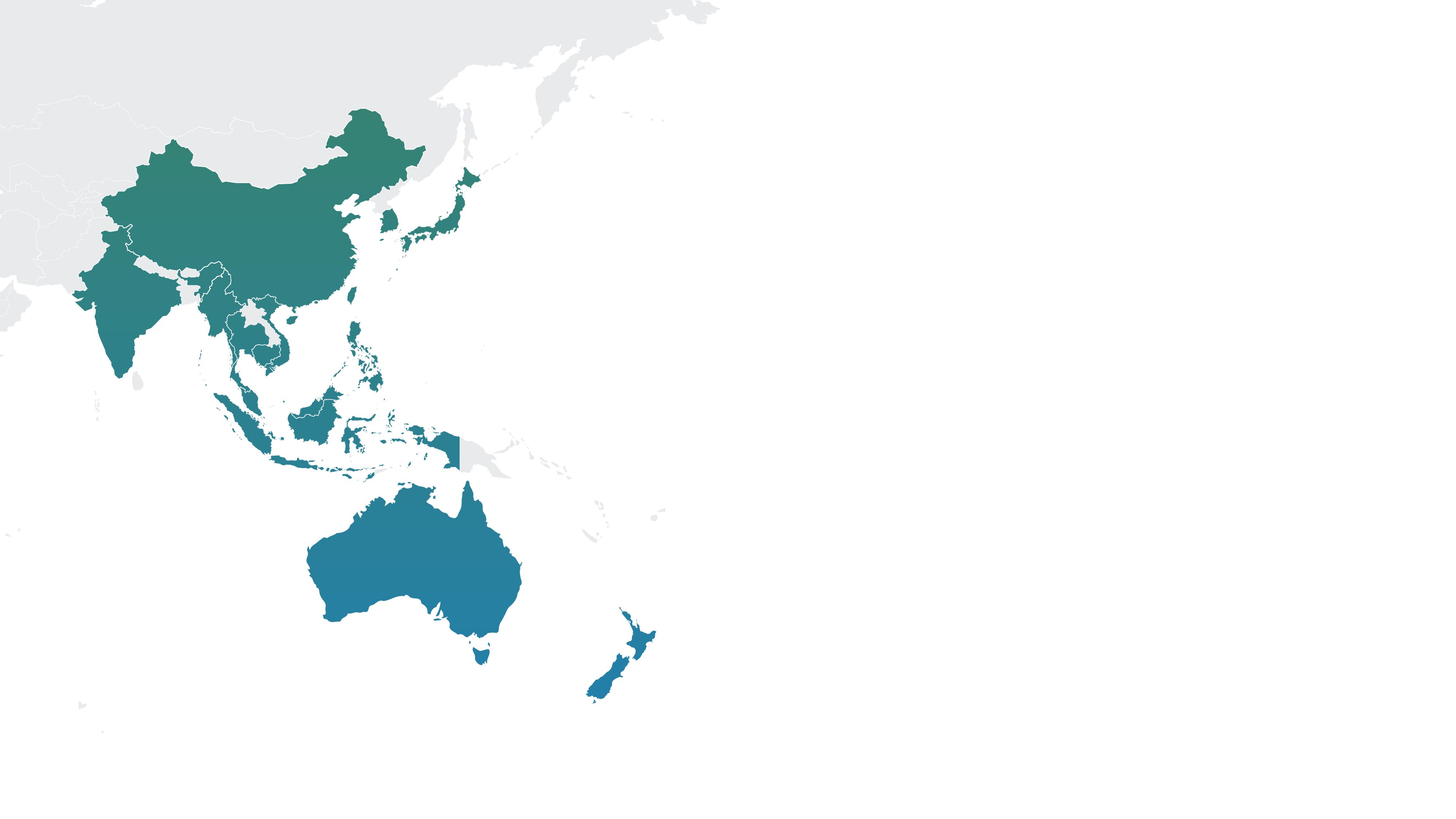

ESG in APAC

Jurisdictional overview on ESG reporting,

transition planning and greenwashing

This publication will help businesses unpack the current ESG regulatory landscape in 16 APAC jurisdictions and get a sense of the commonalities and direction of travel within APAC in relation to three key themes:

- ESG reporting requirements – Investors, financiers and others have been demanding better quality and comparable ESG disclosures from companies for their capital allocation, risk assessment and own reporting obligations. We explore the extent to which APAC jurisdictions have been enhancing their ESG reporting requirements to address this demand, including the extent of any greenhouse gas (GHG) emissions disclosure requirements and convergence around the sustainability and climate change reporting standards[1] issued by the International Sustainability Standards Board (ISSB) just over a year ago.

- Transition planning – We delve into the extent to which there are regulatory requirements or incentives in place for corporates to reduce their GHG emissions. Such regulatory initiatives may include emissions trading schemes (ETS) or other carbon pricing tools anchored by the “polluter pays” principle, as well as requirements for corporates to disclose climate-related targets and transition plans, with the enhanced transparency creating more pressure for companies to develop credible strategies to decarbonise.

- Greenwashing risks - As requirements on ESG reporting and transition planning generally harden, the risks of being accused of greenwashing may correspondingly increase. We explore the extent to which this has translated into any material litigation or regulatory action in APAC and the grounds for such action.

This publication is a collaboration between Slaughter and May and leading independent law firms in APAC. As the first British law firm to open an office in Hong Kong in 1974, Slaughter and May has a long-standing presence in APAC. For half a century, we have acted for our local and international clients on all elements of their APAC matters. We have developed close working relationships with leading independent law firms throughout APAC in order to deliver seamless first-class legal services in many cross-border matters.

Please keep scrolling down to explore overall trends and observations across APAC for each key theme, along with further detailed information on the 16 APAC jurisdictions covered in this publication.

Key themes and observations across APAC

Glossary

|

TERM |

DEFINITION |

|---|---|

|

Carbon credits |

Tradable credits (representing 1 ton of carbon dioxide equivalent) generated through voluntary emissions reduction activities. Carbon credits can represent emissions reductions achieved through either avoidance (preventing GHG emissions from entering the atmosphere) or removal (taking GHGs from the atmosphere). Carbon crediting mechanisms include those administered by international organisations (e.g. Kyoto Protocol (including the Clean Development Mechanism)), non-governmental organisations (e.g. Verra and Gold Standard) and governments. |

|

Carbon tax |

A fee levied by a government on covered entities for their GHG emissions, with the government setting the price of emissions (the tax rate). |

|

Comply-or-explain |

An approach to disclosure whereby a company must either report on a provision or, if it does not, provide considered reasons for not doing so. |

|

Double materiality |

An approach to disclosure which assesses materiality by reference to information that is necessary to understand the reporting entity’s impacts on sustainability matters (impact materiality) and sustainability matters that could reasonably be expected to affect its financial prospects (financial materiality). |

|

ESG |

Environmental, social and governance. |

|

ETS or emissions trading system |

In an ETS, the government places a limit on the amount of GHG emissions from covered entities. Typically, entities must surrender emission units (or allowances) to cover their emissions within a compliance period. Each emission unit represents the right to emit a certain volume of emissions and can be traded between covered entities or sometimes with other traders. The carbon price in these systems is usually a function of supply and demand for emission units. |

|

FY |

Financial year. |

|

GHG or greenhouse gas |

The seven greenhouse gases listed in the Kyoto Protocol: carbon dioxide; methane; nitrous oxide; hydrofluorocarbons; nitrogen trifluoride; perfluorocarbons; and sulphur hexafluoride. |

|

GHG Protocol |

Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (2004). |

|

GRI |

Global Reporting Initiative, an international independent standards organisation founded by, amongst others, the United Nations Environmental Programme, to develop sustainability reporting standards. |

|

GRI Standards |

A set of interrelated sustainability reporting standards that enable organisations to report publicly on their economic, environmental and social impacts and contribution towards sustainable development developed by the Global Sustainability Standards Board of the GRI. |

|

IFRS S1 |

General Requirements for Disclosure of Sustainability-related Financial Information published by the ISSB in June 2023. |

|

IFRS S2 |

Climate-related Disclosures published by the ISSB in June 2023. |

|

IOSCO |

International Organization of Securities Commissions. |

|

ISSB |

International Sustainability Standards Board, an independent, private-sector body that was established by the International Financial Reporting Standards Foundation to develop globally consistent sustainability-related financial reporting standards. |

|

ISSB Standards |

IFRS S1 and IFRS S2. |

|

SASB |

Sustainability Accounting Standards Board, a non-profit organisation, founded in 2011 to develop sustainability accounting standards. In August 2022, the ISSB assumed responsibility for the SASB standards. |

|

Scope 1 emissions |

Direct GHG emissions that occur from sources that are owned or controlled by the reporting entity. |

|

Scope 2 emissions |

Indirect GHG emissions from the generation of purchased or acquired electricity, steam, heating or cooling consumed by the reporting entity. |

|

Scope 3 emissions |

All indirect GHG emissions (not included in Scope 2) that occur in the value chain of the reporting entity, including both upstream and downstream emissions. |

|

Single materiality |

An approach to disclosure which assesses materiality by reference to sustainability matters that could reasonably be expected to affect the reporting entity’s prospects (financial materiality). |

|

TCFD |

Task Force on Climate-related Financial Disclosures, a task force created by the Financial Stability Board to improve and increase reporting of climate-related financial information. On October 12, 2023, the TCFD fulfilled its remit and disbanded, passing responsibility for monitoring the progress of companies’ climate-related disclosures to the International Financial Reporting Standards Foundation. |

|

TCFD Recommendations |

The recommendations of the Task Force on Climate-related Financial Disclosures issued by the TCFD in June 2017. |

|

Transition plan |

A transition plan is generally understood to be an aspect of a company’s overall business strategy that outlines its action plan to mitigate or adapt to climate-related risks for its transition towards a lower carbon economy, including actions such as reducing its GHG emissions. |

The content of this publication represents the position as at 30 June 2024.

This publication is provided for general information only. It does not constitute legal or other professional advice. For further information, please speak to your usual Slaughter and May contact.